Quickbooks paycheck calculator

Exempt means the employee does not receive overtime pay. QuickBooks Payroll is only accessible via QuickBooks Online subscriptions.

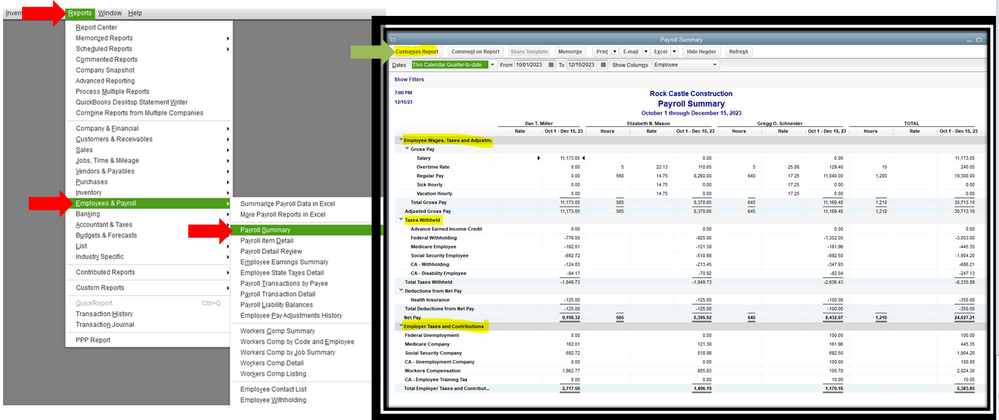

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Payroll services are offered by a third-party Webscale Pty Ltd the makers of KeyPay.

. Go here to get support for Payroll for QuickBooks Online. QuickBooks Desktop Enhanced Payroll for Accountants will not be impacted by this price increase. Intuit Payroll for QuickBooks Online.

You will be charged 500 incl. Youre also limited to 40 classes in QuickBooks Online Plus. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

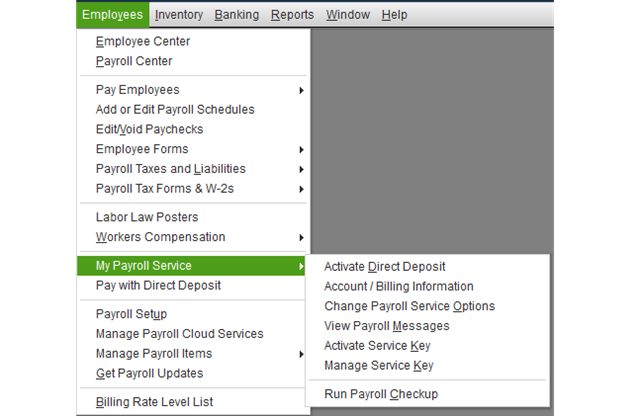

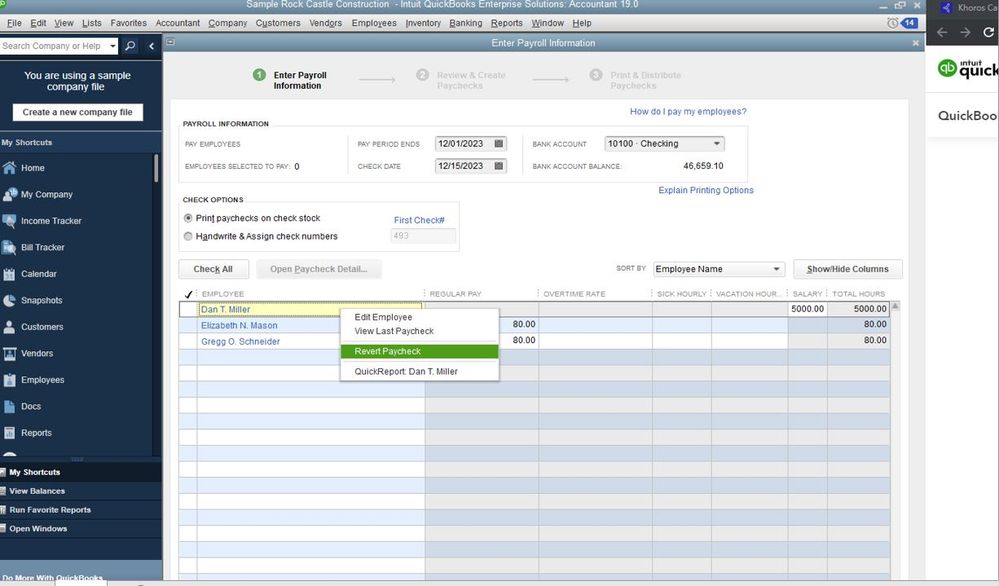

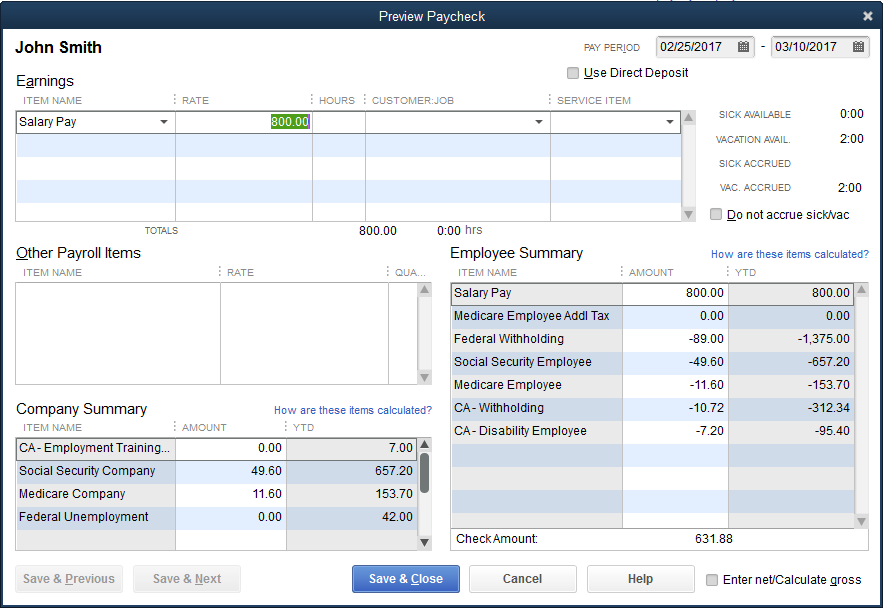

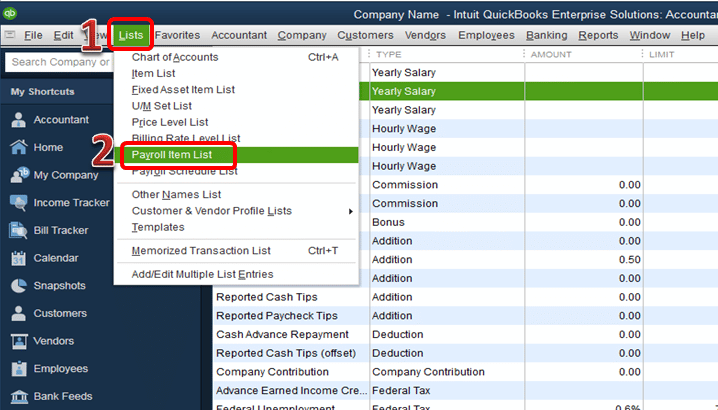

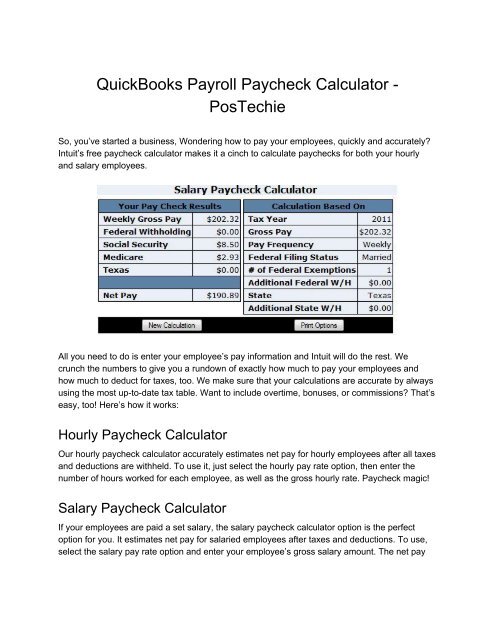

QuickBooks Desktop Enhanced and Basic Payroll subscriptions that have a monthly per-employee fee will see the following price changes on or after Oct. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

GST per month for each active employee paid using QuickBooks Payroll. Locations also found in QuickBooks Online Plus and Advanced allow you to examine the financial resources behind transactions. QuickBooks Payroll powered by KeyPay.

Benefits of Using a Payroll Calculator. What are the QuickBooks Desktop price increases. Then enter the employees gross salary amount.

If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. Classes are also not good for time-based categories such as an event because theyre meant to be permanent.

Sales 800-267-5519 Mon-Fri 6AM to 6 PM Pacific Time Support We provide multiple support options so you can get assistance when you need it. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions.

Manually Enter Payroll Paychecks In Quickbooks Online

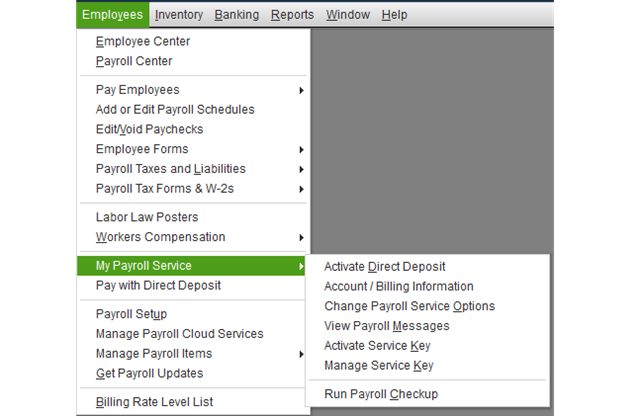

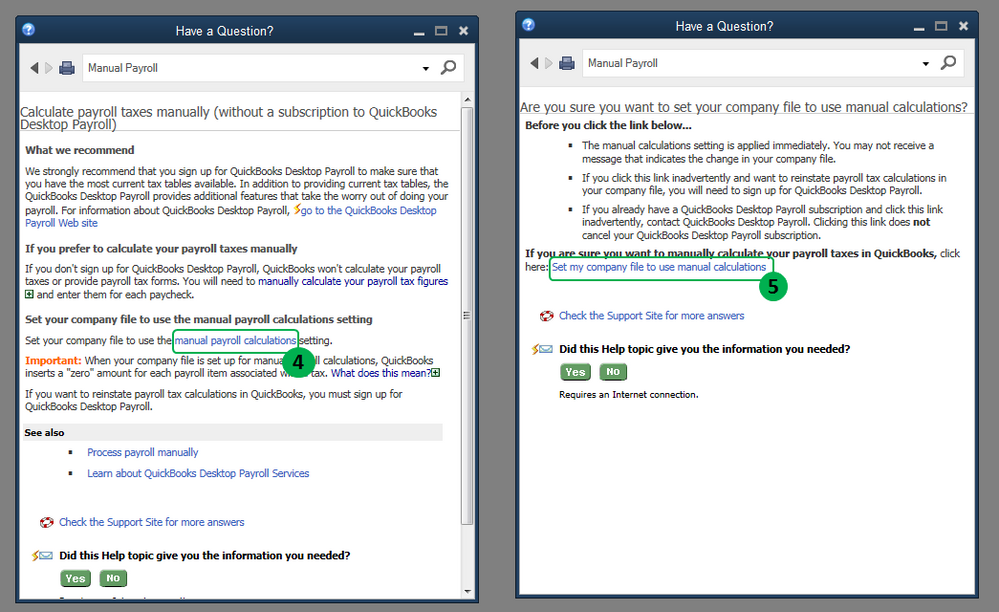

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

Solved Payroll Taxes Not Deducted Suddenly

Calculating Manual Payroll Option Is Not Available

Solved How To Fix Payroll Error In Quickbooks Desktop

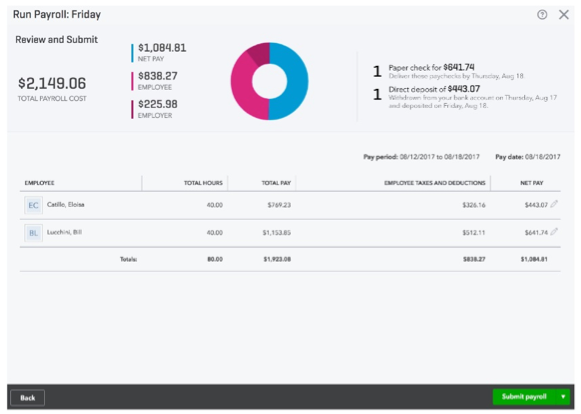

One Day Processing Now Available For Quickbooks Payroll Quickbooks

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Solved Federal Taxes Not Deducted Correctly

Solved Payroll Taxes Not Deducted Suddenly

Solved Other Payroll Items Not Calculating User Defined Payroll Item

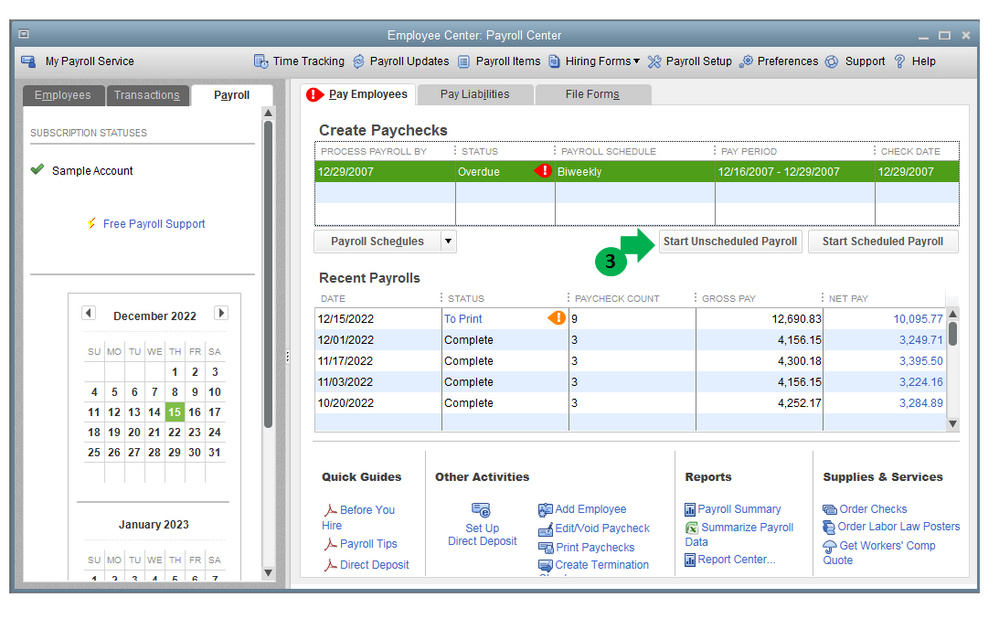

Scheduled Payroll In Quickbooks Assisted Payroll Youtube

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Fix Quickbooks Payroll Taxes Are Calculating Incorrectly Solved

Why Is Quickbooks Not Calculating Salary Pay Based On Peap Year For 2020

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Solved Payroll Taxes Not Deducted Suddenly